tn franchise and excise tax guide

The minimum franchise tax of 100 is payable if you are incorporated. Form FAE170 Schedules and Instructions - For tax years beginning on or after 1121.

What Federal Tax Reform Means For Tennessee

Tax manuals are intended to be a more comprehensive resource for taxpayers who wish to gain a better understanding of Tennessees mostly commonly applicable taxes.

. The franchise tax is a privilege tax imposed on entities for the privilege of doing business in Tennessee. If calling from Nashville or outside. If you had a franchise excise tax account number before May 28 2018 the only change to this number is the addition a zero to the beginning of the number.

Input the Contacts name phone number and email address. A completed franchise and excise tax return FAE170 must be filed electronically with payment of any taxes due by the 15th day of the fourth month following the close of the. FONCE-1 - Qualification and Filing Requirements for the Family Owned Non-Corporate Entity FONCE Exemption.

Tennessee franchise and excise tax guide tenn. Tax credits offset tax liability. This franchise excise tax guide is intended as an informal reference for taxpayers who wish to gain a better understanding of Tennessee franchise excise tax requirements.

If you have questions about Franchise And Excise Tax Online contact. FE-2 - Criteria That Must be Met Before There is a Filing Requirement. Franchise Excise Tax General Information.

Fill in the Taxpayer ID Type ID and Account ID. If applicable short period dates may. The franchise tax is based on the greater of net worth or the book value of real or tangible personal property owned or used in Tennessee.

For business with a 11-1231 calendar year this tax is due on April 15th of the following year. It is not an all. Franchise Excise Tax - Credits.

Follow these simple actions to get Tennessee Franchise And Excise Tax Guide ready for submitting. They are designed to. Penalty on estimated franchise and excise tax payments is calculated at a rate of 2 per month or portion thereof that an.

Franchise Excise Tax - Excise Tax. Tennessee State Government - TNgov. Select the form you need in our library of legal forms.

For more information view the topics below. The excise tax is based on net earnings or income for the tax year. Annual 15th day of the 4th month following the close of your books and records.

FAE170 Franchise and Excise Tax Return. All entities doing business in Tennessee and having a substantial nexus in. The number is 800 397-8395.

The Department of Revenue also offers a toll-free franchise and excise tax information line for Tennessee residents. General Information Enter the beginning and ending dates of the period covered by this return. Franchise Excise Tax Returns and Schedules for Prior Tax Filing Years.

F. FONCE-2 - Relationships That are Considered Family Members for the. This blog series will cover certain aspects of Tennessees Franchise and Excise tax and give particular focus to the more common exemptions available under the taxing.

Tennessee Department of Revenue. Open the form in the online. All persons except those with nonprofit status or otherwise exempt are subject to a 65 corporate excise tax on the net earnings from business.

FE-1 - Entity Types that File Franchise Excise Tax Returns. For Account Type choose Franchise Excise Tax.

Ultimate Excise Tax Guide Definition Examples State Vs Federal

![]()

The Online Sales Tax Guide For Ecommerce Retailers

Tennessee Rentals And The Fonce Exemption Mark J Kohler

Incorporate In Tennessee Do Business The Right Way

Irs Extends Filing And Payment Deadlines For Tax Year 2020 Tax Pro Center Intuit

Monthly Tax Webinar Franchise Excise Tax Basics Youtube

Fill Free Fillable Forms State Of Tennessee

![]()

Monthly Tennessee Tax Revenue Tracker For Fy 2020

State Income Tax Law Changes For Q3 Of 2022

Tax Guide 2007 State Publications I North Carolina Digital Collections

How To Become A Tennessee General Partnership 2022

Don T Ignore Tennessee S Expanding Business Tax Nashville Business Journal

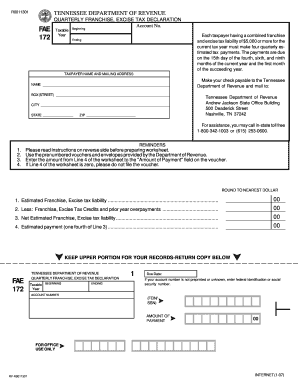

Fae 172 Form Fill Out And Sign Printable Pdf Template Signnow

Fae 170 Fill Online Printable Fillable Blank Pdffiller

2017 2022 Form Tn Dor Fae 173 Fill Online Printable Fillable Blank Pdffiller

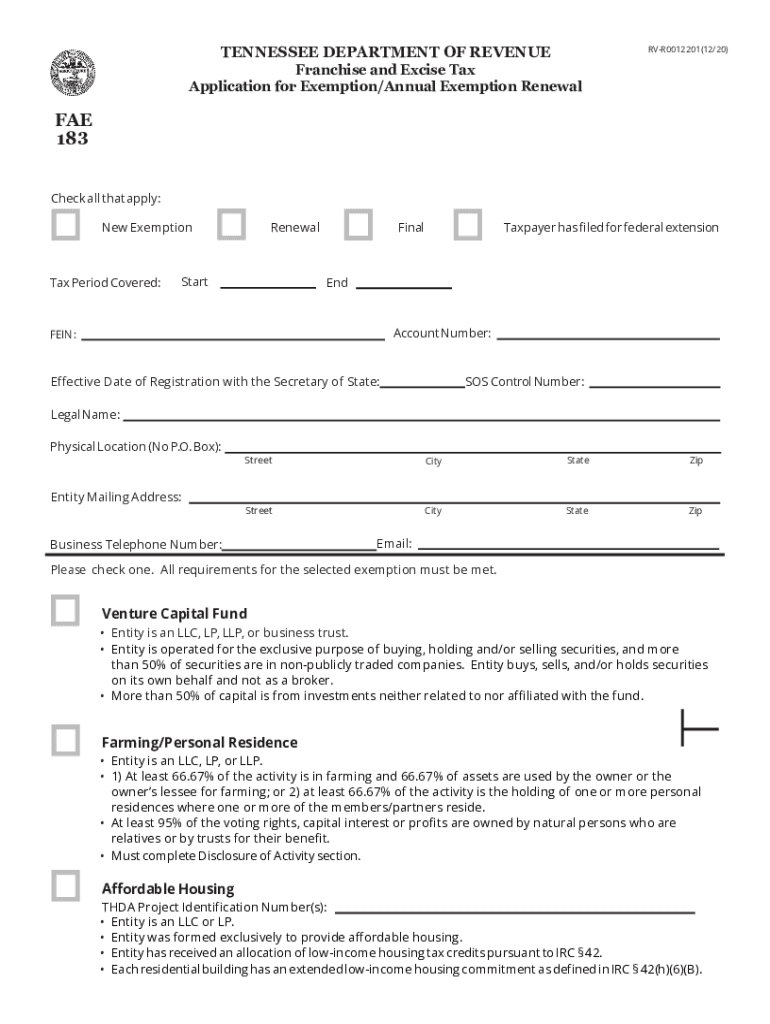

Fae 183 Fill Out Sign Online Dochub

How To Form An Llc In Tennessee Llc Filing Tn Swyft Filings

How To Register For A Sales Tax Permit In Tennessee Taxvalet